The Bank of Japan Faces Daunting Challenges

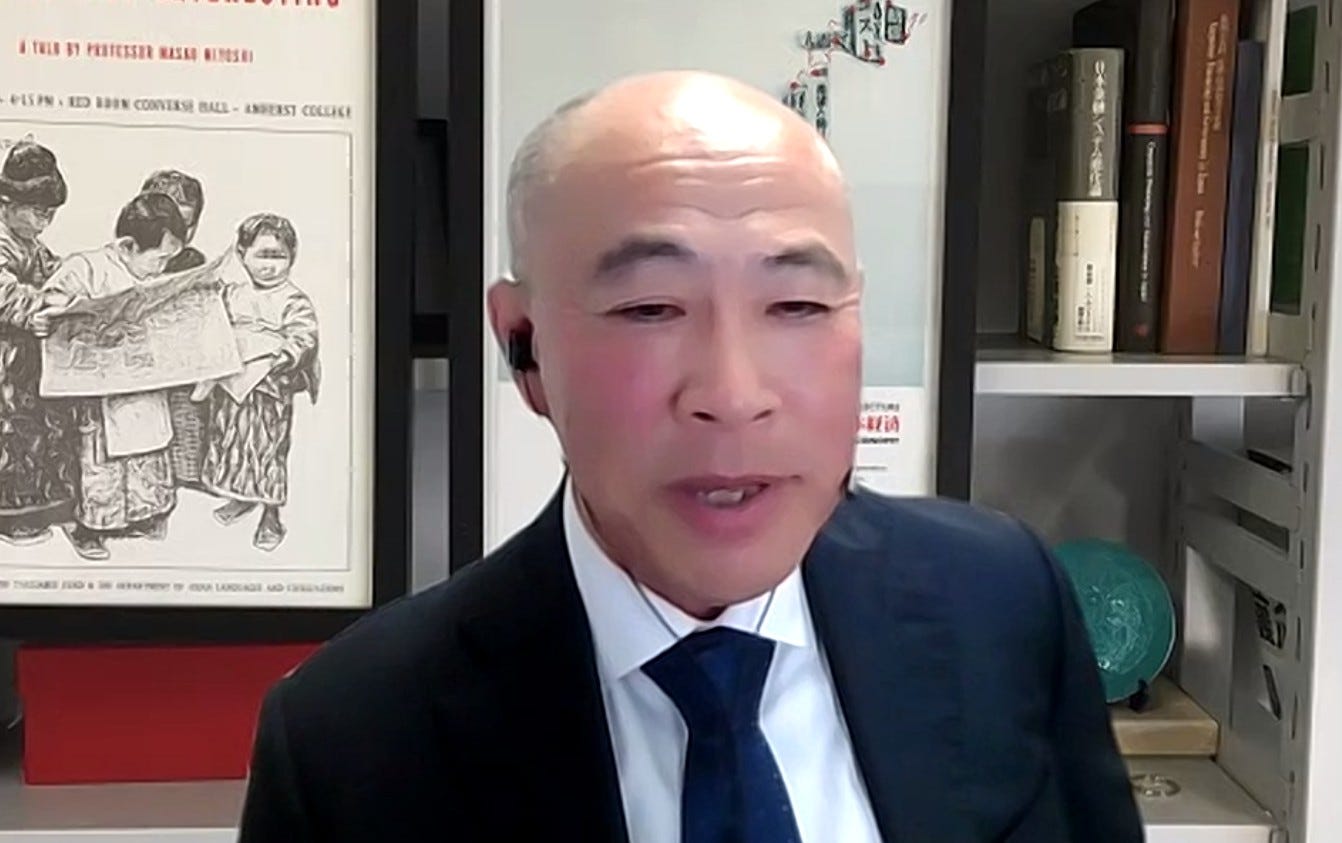

Economist Takeo Hoshi, Dean of the University of Tokyo’s Graduate School of Economics

Professor Takeo Hoshi spoke earlier this week about daunting challenges faced by the next Bank of Japan Governor in a Zoominar organized by UC San Diego School of Global Policy and Strategy. Hoshi, who studied economics under Stanley Fischer at MIT, is Dean of the University of Tokyo’s Graduate School of Economics.

Hoshi suggests Japan now enjoys low interest rates, despite the nation's huge budget deficit, because capital markets think Japan’s national debt is sustainable. Conversely, the debt is sustainable because interest rates are low.

However, it is possible market sentiment suddenly changes, causing interest rates to rise to levels which make government debt unsustainable. Then, “the debt becomes unsustainable, because the interest rate is high,” he circularly argues.

Higher rates are bad news for Japanese government bonds that were barely sustainable to start with because they, “make it clear the Japanese government debt is unsustainable,” he says.

Ironically, Hoshi is less worried about the impact higher rates might have on the BOJ’s thinly capitalized balance sheet. High interest rates could force the central bank into technical bankruptcy. In practice, the Government of Japan would recapitalize the BOJ, so the BOJ can never go bankrupt. “I guess the question is BOJ independence,” he says. If bailed out, “it becomes clear they are part of the government and will make it harder to conduct their monetary policy in a responsible way.”

Other economists also discount the significance of BOJ recapitalization, on similar grounds. It remains unclear, at least in my mind, why a government bailout would not be a likely catalyst which tips investor sentiment.

The BOJ spent a massive $240bn (equal to almost 6% of GDP) defending a yield-curve control cap on 10-year bond rates, after it eased them from .25% to .50% in December. On lifting the cap, investors began dumping their existing JGB holdings, in expectation of future monetary tightening. The BOJ, which continues to maintain loose monetary policy, has been an outlier among central banks. Elsewhere, central banks have already tightened monetary policy to head off rising inflation.

The solution to Japan’s fiscal sustainability, Hoshi believes, is to increases tax and reduce government expenditures. In addition, Japan needs to overhaul competition policy so firms become more productive. "Otherwise, the Japanese government will get to the point they can't finance its operations by issuing more debt."

Unfortunately, neither solution is in the BOJ’s scope or toolbox. The BOJ faces the near impossible task of unwinding prior quantitative easing. Professor Ulrike Schaede, who led the Zoominar, rightly called the next BOJ Governor’s job "thankless".

Richard Solomon is an author, publisher and spokesman on contemporary Japan. He posts Beacon Reports at beaconreports.net